6 Effective Marketing Strategies Used In Banks

In the highly competitive banking industry, effective marketing strategies play a pivotal role in attracting customers, driving business growth, and maintaining a competitive edge. As the financial landscape evolves and customer expectations shift, banks must leverage innovative and targeted marketing approaches to stay ahead.

This article explores six effective marketing strategies used in banks that have proven successful in maximizing growth and customer engagement. By implementing these strategies, banks can build brand awareness, foster customer loyalty, and generate new business opportunities.

1: Market Research and Analysis

Market research and analysis play a crucial role in developing effective marketing strategies for banks. This section will delve into the key components and techniques involved in conducting market research and utilizing data-driven insights to inform decision-making.

I. Identifying Target Segments

- Importance of understanding the bank’s target audience and their characteristics

- Conducting demographic, psychographic, and behavioral research to identify target segments

- Utilizing customer segmentation techniques to categorize customers based on their needs, preferences, and behavior

II. Understanding Customer Needs and Preferences

- Conducting surveys, interviews, and focus groups to gain insights into customer needs and preferences

- Analyzing customer feedback and complaints to identify pain points and areas for improvement

- Utilizing customer analytics tools to track customer behavior, preferences, and satisfaction levels

III. Leveraging Data-Driven Insights

- Utilizing data analytics tools to gather and analyze customer data, market trends, and industry insights

- Applying statistical analysis to identify patterns, trends, and correlations in data

- Using data-driven insights to inform marketing strategies, product development, and customer experience enhancements

IV. Competitor Analysis

- Importance of analyzing competitors’ strategies, strengths, weaknesses, and market positioning

- Conducting competitive intelligence research to identify market opportunities and threats

- Benchmarking against competitors to identify areas of differentiation and competitive advantage

V. Tailoring Marketing Efforts and Messaging

- Utilizing market segmentation to develop targeted marketing campaigns for specific customer segments

- Crafting compelling marketing messages that resonate with the identified target segments

- Personalizing marketing efforts based on customer preferences, demographics, and behavior

By conducting comprehensive market research, analyzing customer data, understanding competitors, and utilizing segmentation techniques, banks can develop targeted and effective marketing strategies that align with their customer’s needs and preferences.

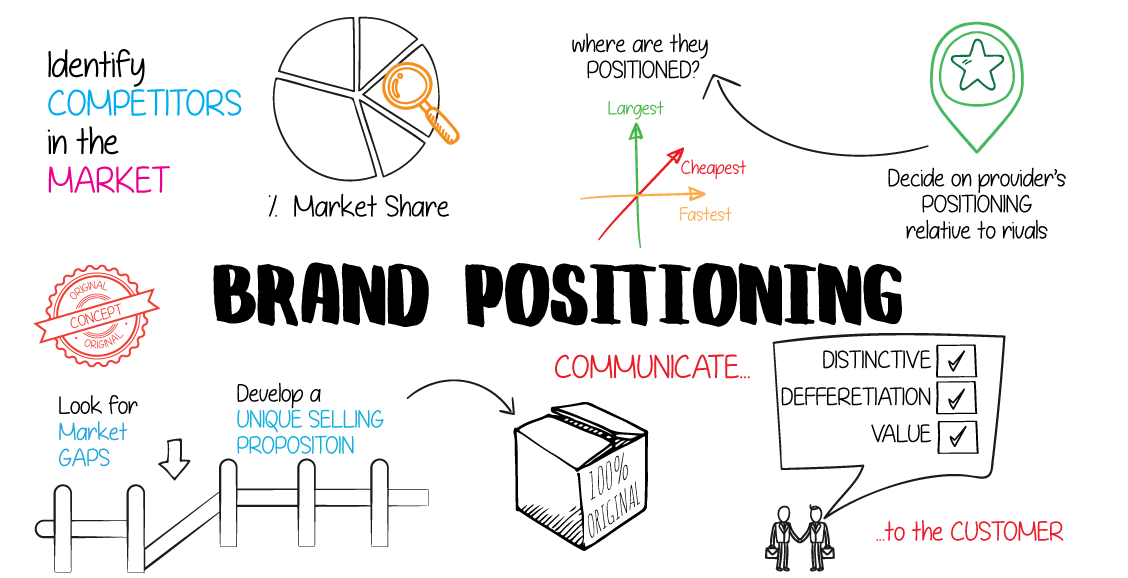

2: Branding and Positioning

Establishing a strong brand identity and positioning is crucial for banks to differentiate themselves in a competitive market. This section will focus on key strategies for branding and positioning in the banking industry.

I. Establishing a Strong Brand Identity

- Importance of strong brand identity in building trust and credibility

- Defining brand values, mission, and vision that align with the target audience

- Creating a compelling brand story and messaging that resonates with customers

- Developing a visual identity including logo, colors, typography, and design elements

II. Crafting a Unique Value Proposition

- Identifying unique features, benefits, and strengths that set the bank apart from competitors

- Understanding customer needs and pain points to develop a value proposition that addresses them

- Communicating the value proposition clearly and effectively in all marketing communications

III. Brand Positioning Strategies

- Conducting market research to understand customer perceptions and competitor positioning

- Identifying a positioning strategy that differentiates the bank in the market

- Targeting specific customer segments and tailoring positioning messages accordingly

- Developing a positioning statement that communicates the bank’s unique value in a concise manner

IV. Creating Brand Guidelines

- Developing brand guidelines to maintain consistency in brand representation

- Defining guidelines for logo usage, color schemes, typography, and tone of voice

- Ensuring consistency across all marketing channels, including digital and offline media

- Providing training and resources to internal stakeholders to adhere to brand guidelines

A strong brand identity, compelling value proposition, effective brand positioning, and consistent brand representation across all marketing channels are essential for banks to differentiate themselves and build customer trust and loyalty.

3: Product and Service Marketing

In the banking industry, effective marketing of products and services is crucial for driving customer acquisition, increasing revenue, and maximizing customer lifetime value. This section will delve into key strategies for product and service marketing in the banking industry.

I. Identifying Key Products and Services

- Conducting market research to identify customer needs, preferences, and demands

- Analyzing profitability and market demand to prioritize products and services for promotion

- Identifying key differentiators and competitive advantages of the bank’s offerings

II. Designing Effective Product Marketing Campaigns

- Crafting compelling marketing messages that highlight the features, benefits, and competitive advantages of the products and services

- Utilizing various marketing channels, including digital platforms, print media, and in-branch promotions, to reach the target audience

- Developing creative and visually appealing marketing collateral, such as brochures, flyers, and digital advertisements

- Implementing targeted campaigns that resonate with specific customer segments, taking into account their needs and preferences

III. Cross-Selling and Upselling Strategies

- Identifying opportunities for cross-selling and upselling by analyzing customer behavior and transaction history

- Developing personalized offers and recommendations based on customer profiles and needs

- Leveraging customer relationship management (CRM) systems to track and manage cross-selling and upselling efforts

- Implementing effective communication strategies to educate customers about additional products and services that complement their existing relationship with the bank

IV Tailoring Marketing Messages to Different Customer Segments

- Segmenting the customer base based on demographic, psychographic, and behavioral characteristics

- Customizing marketing messages and channels to resonate with each customer segment

- Utilizing data-driven insights to personalize marketing communications and offers

- Implementing customer journey mapping to understand touchpoints and deliver targeted messages at each stage of the customer lifecycle

By identifying key products and services, designing effective marketing campaigns, implementing cross-selling and upselling strategies, and tailoring marketing messages to different customer segments, banks can effectively promote their offerings and maximize customer engagement and satisfaction.

4: Digital Marketing and Online Presence

In today’s digital age, establishing a strong online presence and effectively leveraging digital marketing channels is crucial for banks to reach and engage customers. This section will delve into key strategies for digital marketing and optimizing the online presence of banks.

I. Leveraging Digital Channels

To reach and engage customers, banks should leverage various digital channels such as websites, social media platforms, email marketing, and online advertising. A well-rounded digital marketing strategy allows banks to connect with customers at different touchpoints throughout their customer journey.

Websites serve as a central hub for banks’ online presence. A user-friendly website that provides valuable information, showcases products and services, and enables seamless interactions with customers is essential. Banks should focus on optimizing their website for search engines (SEO) to improve visibility in search results and attract organic traffic.

Social media platforms provide an opportunity for banks to increase brand awareness, engage with customers, and share valuable content. By maintaining an active presence on platforms relevant to their target audience, banks can build an online community, foster customer relationships, and address customer queries and concerns in real time.

Email marketing allows banks to communicate directly with customers by delivering personalized messages, updates, and promotional offers. Building an email list and segmenting customers based on their preferences and behaviors enables banks to provide tailored content and offers, increasing engagement and driving conversions.

Online advertising, including search engine marketing (SEM) and display advertising, helps banks reach their target audience with targeted messaging and drive traffic to their website or landing pages. By leveraging digital advertising platforms, banks can enhance brand visibility, generate leads, and increase conversions.

II. Developing a User-Friendly Website and Optimizing for SEO

A user-friendly website is crucial for attracting and retaining customers. Banks should prioritize creating a website that is visually appealing, easy to navigate, and provides a seamless user experience across different devices. Clear and intuitive navigation, well-structured content, and prominent calls-to-action facilitate customer engagement and drive conversions.

Optimizing the website for search engines (SEO) is essential to increase organic visibility in search results. Banks should conduct keyword research to understand the search terms customers use when looking for banking services. By incorporating relevant keywords into website content, meta tags, and URLs, banks can improve their rankings in search engine results pages (SERPs). Additionally, optimizing website loading speed, implementing mobile responsiveness, and ensuring secure browsing (HTTPS) contribute to a positive user experience and improve search engine rankings.

III. Implementing Content Marketing Strategies

Content marketing plays a crucial role in building customer trust and establishing banks as industry leaders. By providing valuable and informative content, banks can engage customers and position themselves as trusted advisors. Content marketing strategies may include publishing blog articles, creating informative videos, producing infographics, and developing educational guides. Banks should focus on addressing customer pain points, offering financial tips, explaining banking products and services, and providing insights into industry trends.

Content distribution is as important as content creation. Banks can leverage various channels such as their website, social media platforms, email newsletters, and guest posting on relevant industry websites to distribute their content and reach a wider audience. Engaging with customers through comments, shares, and discussions fosters relationships and encourages brand advocacy.

IV. Utilizing Social Media Marketing

Social media platforms offer immense opportunities for banks to increase brand awareness, engage with customers, and showcase their offerings. Banks should identify the social media platforms preferred by their target audience and create a consistent presence on those platforms. By sharing relevant and engaging content, responding to customer inquiries, and leveraging paid social media advertising, banks can amplify their reach and foster customer loyalty.

Social media marketing also allows banks to leverage influencer partnerships and user-generated content to enhance brand credibility and reach a wider audience. Collaborating with influencers who align with the bank’s values and target audience can help drive brand awareness and generate trust among potential customers.

In conclusion, leveraging digital channels, developing user-friendly websites optimized for SEO, implementing content marketing strategies, and utilizing social media marketing are key strategies for banks to strengthen their online presence, engage customers, and build lasting relationships in the digital era.

5. Customer Relationship Management

Building strong relationships with customers is vital for long-term loyalty and success in the banking industry. This section will explore the importance of customer relationship management (CRM) and strategies to personalize marketing efforts, enhance the customer experience, and promote customer retention.

I. Importance of Building Strong Customer Relationships

In the competitive banking landscape, establishing and maintaining strong customer relationships is crucial. Customers are more likely to stay loyal to banks that prioritize their needs, provide personalized experiences, and consistently deliver value. Building strong relationships leads to increased customer satisfaction, positive word-of-mouth referrals, and higher customer lifetime value.

By focusing on building relationships, banks can gain insights into their customers’ financial goals, preferences, and behaviors. This knowledge allows banks to offer tailored solutions, provide proactive financial advice, and anticipate customer needs, fostering trust and loyalty.

II. Implementing Effective Customer Relationship Management (CRM) Systems

Implementing a robust CRM system is essential for managing and nurturing customer relationships. CRM systems enable banks to centralize customer data, track interactions, and segment customers based on their preferences and behaviors. With a comprehensive view of each customer, banks can provide personalized experiences, targeted marketing campaigns, and timely support.

CRM systems also facilitate effective communication and collaboration among bank employees. Customer information can be shared across departments, ensuring a unified approach to customer service and enabling seamless interactions at every touchpoint.

III. Utilizing Customer Data for Personalized Marketing Efforts and Enhanced Customer Experience

Customer data is a valuable asset that banks can leverage to deliver personalized marketing efforts and enhance the customer experience. By analyzing customer data, such as transaction history, browsing behavior, and demographic information, banks can segment customers into distinct groups and create targeted marketing campaigns.

Personalized marketing efforts can include tailored product recommendations, customized offers, and relevant content. By delivering the right message to the right customer at the right time, banks can increase engagement, drive conversions, and strengthen customer loyalty.

Banks can also leverage customer data to enhance the customer experience. For example, by analyzing transaction patterns, banks can identify opportunities to streamline processes, improve self-service options, and offer personalized financial advice. By proactively addressing customer needs and preferences, banks can foster a positive customer experience and build long-term loyalty.

IV. Implementing Customer Retention Strategies

Customer retention is a key objective for banks aiming to build a loyal customer base. Implementing effective customer retention strategies ensures that customers stay engaged and continue to choose the bank’s products and services. Some strategies include:

- Loyalty Programs: Implementing loyalty programs that reward customers for their continued business. This can include point-based systems, tiered rewards, or exclusive benefits for loyal customers.

- Personalized Offers: Tailoring offers and promotions based on each customer’s preferences, transaction history, or life events. By offering personalized incentives, banks can increase customer engagement and satisfaction.

- Proactive Customer Service: Providing exceptional customer service by anticipating customer needs and resolving issues promptly. This includes offering multiple channels for customer support, such as phone, email, chat, or in-person interactions.

- Continuous Engagement: Regularly engaging with customers through targeted communications, such as newsletters, educational content, or personalized updates. This helps to strengthen the relationship, provide ongoing value, and reinforce the bank’s brand.

- Feedback and Surveys: Seeking feedback from customers through surveys and feedback forms to understand their satisfaction levels, identify areas for improvement, and address concerns promptly. Actively listening to customer feedback demonstrates that the bank values their opinions.

By implementing these customer retention strategies, banks can increase customer satisfaction, reduce customer churn, and foster long-term loyalty.

In conclusion, building strong customer relationships, implementing effective CRM systems, utilizing customer data for personalization, and implementing customer retention strategies are vital for banks seeking to enhance loyalty and long-term success in the competitive banking industry.

6: Measuring and Evaluating Marketing Effectiveness

Measuring and evaluating marketing effectiveness is crucial for banks to assess the impact of their marketing efforts, make data-driven decisions, and optimize strategies. This section will discuss the importance of setting clear marketing objectives, monitoring key performance indicators (KPIs), utilizing marketing automation tools and analytics platforms, and making data-driven decisions to enhance marketing effectiveness.

I. Setting Clear Marketing Objectives and Key Performance Indicators (KPIs)

To measure marketing effectiveness, banks must establish clear marketing objectives aligned with their overall business goals. These objectives should be specific, measurable, attainable, relevant, and time-bound (SMART). Examples of marketing objectives for banks could include increasing brand awareness, acquiring new customers, promoting specific banking products, or improving customer retention.

Once marketing objectives are defined, banks need to identify key performance indicators (KPIs) that align with each objective. KPIs are quantifiable metrics that help track progress and measure the success of marketing initiatives. Examples of KPIs in the banking industry can include website traffic, conversion rates, customer acquisition cost, customer lifetime value, customer satisfaction scores, and social media engagement.

II. Monitoring and Analyzing Marketing Metrics to Evaluate Campaign Effectiveness

Monitoring and analyzing marketing metrics is essential for evaluating the effectiveness of marketing campaigns. Banks should regularly track and evaluate relevant metrics to assess the performance of their marketing initiatives. Some important metrics to monitor in the banking industry include:

- Website Analytics: Tracking website traffic, page views, bounce rates, and conversion rates to assess the effectiveness of digital marketing campaigns and website optimization efforts.

- Conversion Rates: Measuring the percentage of website visitors who complete desired actions, such as account sign-ups, loan applications, or product inquiries.

- Customer Acquisition Cost (CAC): Calculating the cost of acquiring new customers by dividing the total marketing costs by the number of new customers acquired during a specific period.

- Customer Lifetime Value (CLV): Determining the projected revenue a bank can expect from a customer over their entire relationship with the bank. CLV helps assess the long-term profitability of acquired customers.

- Social Media Engagement: Monitoring metrics such as likes, comments, shares, and click-through rates to evaluate the engagement and impact of social media marketing efforts.

III. Utilizing Marketing Automation Tools and Analytics Platforms to Track Performance

To streamline data collection and analysis, banks can leverage marketing automation tools and analytics platforms. These tools help collect, organize, and analyze marketing data, providing valuable insights into campaign performance. Some popular marketing automation and analytics platforms include Google Analytics, HubSpot, Salesforce, and Adobe Analytics.

Marketing automation tools enable banks to automate repetitive marketing tasks, track customer interactions, segment audiences, and personalize marketing communications. Analytics platforms provide in-depth reporting, data visualization, and advanced analytics capabilities, allowing banks to gain actionable insights and measure the impact of their marketing efforts accurately.

IV. Making Data-Driven Decisions and Optimizing Strategies Based on Insights

To improve marketing effectiveness, banks should make data-driven decisions based on the insights gathered from marketing metrics and analytics. By analyzing data, banks can identify trends, uncover patterns, and understand customer behavior, enabling them to optimize marketing strategies.

Data-driven decision-making involves continuously evaluating marketing performance, identifying areas of improvement, and testing new strategies. By leveraging insights, banks can refine targeting, messaging, channel selection, and creative elements to enhance marketing effectiveness and achieve better results.

In conclusion, measuring and evaluating marketing effectiveness is essential for banks to optimize their marketing strategies and achieve desired outcomes. Setting clear marketing objectives and KPIs, monitoring relevant metrics, utilizing marketing automation tools and analytics platforms, and making data-driven decisions are key practices that can help banks evaluate campaign performance and drive continuous improvement in their marketing efforts.

Conclusion

These six effective marketing strategies—market research, branding, product marketing, digital presence, customer relationship management, and measuring effectiveness—are crucial for banks to thrive in a competitive industry. By understanding customers, establishing a strong brand, promoting products and services, leveraging digital channels, nurturing relationships, and evaluating performance, banks can achieve differentiation and sustainable growth. Embracing these strategies will empower banks to navigate the ever-changing market landscape and deliver exceptional value to their customers.