Which Quickbooks Should I Use For Rental Property

When it comes to managing rental properties, finding the right accounting software is crucial. QuickBooks, a popular and widely used accounting software, offers solutions specifically tailored for rental property management. In this article, we will explore the different versions of QuickBooks and help you determine which one is best suited for your rental property needs.

Overview of QuickBooks and Its Benefits for Rental Property Owners

QuickBooks is a widely recognized and trusted accounting software that offers various benefits for rental property owners. Whether you manage a single property or have a portfolio of rentals, QuickBooks provides powerful tools to streamline your financial management. In this section, we will explore the overview of QuickBooks and delve into the benefits it offers for rental property owners.

What is QuickBooks?

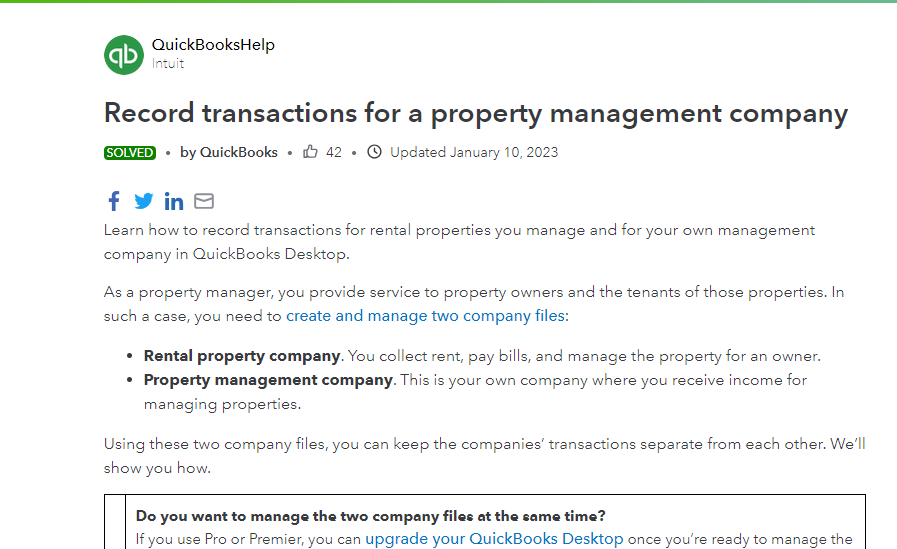

QuickBooks is an accounting software developed by Intuit that caters to the needs of small to medium-sized businesses, including rental property owners. It offers both an online version (QuickBooks Online) and a desktop version (QuickBooks Desktop), each with its own features and capabilities.

Key Benefits of Using QuickBooks for Rental Property Owners

QuickBooks is a popular accounting software that offers a range of benefits for rental property owners. Whether you own a single property or manage a portfolio of rental properties, here are some key benefits of using QuickBooks:

a). Simplified Expense Tracking: QuickBooks allows you to easily track and categorize expenses related to your rental properties, such as maintenance costs, repairs, property management fees, and more. This helps you maintain accurate records and simplifies tax preparation.

b). Rental Income Management: With QuickBooks, you can efficiently manage rental income by tracking rent payments, generating invoices for tenants, and recording rental deposits. This ensures you have a clear overview of your cash flow and helps you stay organized.

c). Financial Reporting: QuickBooks provides robust reporting features, allowing you to generate financial reports specific to your rental properties. These reports provide valuable insights into your property’s performance, occupancy rates, and profitability, enabling you to make informed decisions.

d). Tax Preparation Made Easy: QuickBooks simplifies tax preparation by providing tools to organize and categorize your income and expenses. It helps you generate reports required for tax filing, such as Schedule E and ensures compliance with tax regulations.

e). Integration with Other Tools: QuickBooks integrates with various third-party applications, such as property management software, payment processors, and banking institutions. This enables seamless data transfer and streamlines your rental property management processes.

f). Accessibility and Collaboration: QuickBooks Online offers the advantage of cloud-based accessibility, allowing you to access your financial data from anywhere with an internet connection. It also supports multi-user collaboration, making it easier to work with your property management team or accountant.

g). Scalability: Whether you have a single rental property or a growing portfolio, QuickBooks can scale your business. You can add new properties and expand your accounting needs without significant disruptions.

Factors to Consider When Choosing QuickBooks for Rental Property Management

When choosing QuickBooks for rental property management, there are several factors to consider:

- Accounting Needs: Assess your specific accounting requirements for rental property management. Consider whether you need features such as tracking income and expenses, generating reports, invoicing tenants, managing bank accounts, and reconciling transactions.

- Scalability: Determine whether QuickBooks can accommodate the size and growth of your rental property portfolio. Ensure it can handle the number of properties, units, tenants, and transactions you anticipate managing.

- User-Friendliness: Evaluate the user interface and ease of use of QuickBooks. Consider whether it provides a straightforward and intuitive experience for entering data, navigating through features, and generating reports.

- Customization Options: Determine if QuickBooks allows you to customize your accounts, categories, and reports to suit the specific needs of your rental property business. Flexibility in tailoring the software to your requirements can streamline your workflows.

- Integration Capabilities: Assess the integration options of QuickBooks with other software tools or services you use for rental property management. Consider whether it can connect with property management software, online rent collection platforms, tenant screening services, or other relevant applications to enhance your operations.

- Reporting Capabilities: Review the reporting capabilities of QuickBooks. Look for features that provide insights into your rental property performance, such as profit and loss statements, balance sheets, cash flow reports, and specific rental property reports like Schedule E reports.

- Mobile Access: Determine whether QuickBooks provides mobile access through a dedicated app or other means. Mobile access can be valuable for managing rental property finances on the go or when working remotely.

- Support and Resources: Consider the availability of customer support and educational resources for QuickBooks. Evaluate the quality of support options such as documentation, tutorials, community forums, and the responsiveness of the QuickBooks support team.

- Cost: Assess the pricing structure of QuickBooks and compare it to your budget and the value it provides. Consider whether it offers a one-time purchase model or a subscription-based plan, and weigh the costs against the features and benefits you require.

- Industry-Specific Features: Recognize that QuickBooks is a general accounting software and may lack certain industry-specific features specific to rental property management. Compare its capabilities with dedicated property management software like Landlord Studio to determine if QuickBooks meets your specific needs.

It’s essential to carefully evaluate how well QuickBooks aligns with your rental property management requirements. Compare it with other software options available in the market, read user reviews, and explore demos or trial versions to get a hands-on experience before making a decision.

Understanding Rental Property Accounting Needs

Proper accounting is essential for effectively managing rental properties and ensuring financial success. In this section, we will delve into the key aspects of rental property accounting, highlighting the specific needs and considerations that landlords should be aware of. Understanding these accounting needs will help you make informed decisions about the tools and software you use to manage your rental property finances.

1. Tracking Rental Income and Expenses

Accurate tracking of rental income and expenses is fundamental to rental property accounting. This involves:

- Recording rental income from tenants, including rent payments, security deposits, and any additional fees or charges.

- Tracking various expenses associated with your rental properties, such as property maintenance, repairs, insurance, property taxes, mortgage payments, utilities, and management fees.

Proper tracking allows you to assess the profitability of each property, identify tax-deductible expenses, and analyze the overall financial health of your rental portfolio.

2. Differentiating Revenue Streams

As a rental property owner, you may have multiple revenue streams beyond rental income. These could include:

- Income from laundry facilities, vending machines, or parking spaces.

- Reimbursements from tenants for specific expenses, such as utility bills.

- Other sources of income related to your rental properties, such as late fees or application fees.

It’s important to accurately track and differentiate these revenue streams for better financial reporting and analysis.

3. Expense Categorization and Classification

Proper expense categorization is crucial for organizing your financial records and simplifying tax preparation. Some common expense categories for rental properties include:

- Repairs and maintenance

- Property management fees

- Insurance premiums

- Property taxes

- Mortgage interest

- Utilities

- Advertising and marketing expenses

- Legal and professional fees

Categorizing expenses correctly helps you identify deductible expenses, analyze spending patterns, and generate accurate financial reports.

4. Documentation and Record-Keeping

Maintaining thorough documentation and records is essential for rental property accounting. This includes:

- Keeping copies of invoices, receipts, and bills related to rental income and expenses.

- Storing lease agreements, tenant applications, and rental property documents.

- Maintaining records of security deposits and their disposition.

- Tracking lease renewals, terminations, and rent adjustments.

Proper documentation ensures transparency, and compliance with legal requirements, and simplifies audits or tax inquiries.

5. Reporting and Tax Compliance

Rental property owners need to generate various financial reports to assess the performance of their properties and fulfill tax obligations. Key reports include:

- Profit and Loss (P&L) statement: Provides an overview of income and expenses, allowing you to analyze profitability.

- Balance Sheet: This shows the financial position of your rental properties, including assets, liabilities, and equity.

- Cash Flow Statement: Tracks the inflow and outflow of cash from rental operations, indicating financial health and liquidity.

- Schedule E: Specifically used for reporting rental property income and expenses for tax purposes.

Generating accurate reports enables you to monitor your property’s financial performance, make data-driven decisions, and simplify tax filing.

Understanding these rental property accounting needs will help you evaluate the suitability of accounting software solutions like QuickBooks or specialized property management software, such as Landlord Studio. In the following sections, we will explore the benefits and considerations of using QuickBooks for rental property management.

QuickBooks Online for Rental Property Management

QuickBooks Online is a popular accounting software that can be used for rental property management. Here are some key points to consider when using QuickBooks Online for rental property management:

- Tracking Income and Expenses: QuickBooks Online allows you to track rental income and expenses associated with your rental properties. You can create separate accounts or categories for each property to keep your finances organized.

- Bank Reconciliation: QuickBooks Online offers bank reconciliation features, which help you match your transactions with bank statements, ensuring accurate accounting records for your rental properties.

- Invoicing and Rent Collection: You can create and send invoices to your tenants directly from QuickBooks Online. It also provides options for online payment processing, allowing your tenants to pay rent electronically.

- Reporting: QuickBooks Online provides various reporting options to analyze your rental property finances. You can generate reports such as Profit and Loss, Balance Sheet, and Cash Flow Statement, giving you insights into your property’s performance.

- Integration with Third-Party Apps: QuickBooks Online offers integration capabilities with a wide range of third-party apps. This allows you to connect with property management tools, tenant screening services, and other applications that can enhance your rental property management processes.

- Accessibility and Collaboration: QuickBooks Online is a cloud-based software, accessible from anywhere with an internet connection. You can grant access to your accountant or property manager, enabling collaboration and real-time updates.

- Mobile App: QuickBooks Online has a mobile app, available for iOS and Android devices, allowing you to manage your rental property finances on the go.

- Subscription Pricing: QuickBooks Online operates on a subscription-based pricing model. The cost varies depending on the plan you choose and the number of users. The subscription fee includes access to regular updates and customer support.

While QuickBooks Online offers several features for rental property management, it’s worth noting that it is not specifically designed for landlords. It may lack some industry-specific features found in dedicated property management software like Landlord Studio.

Ultimately, the choice between QuickBooks Online and other rental property management software depends on your specific needs and preferences. Consider factors such as the size of your portfolio, the level of customization required, integration requirements, and your comfort with using accounting software.

Before making a decision, you can explore demos, tutorials, and user reviews to get a better understanding of how QuickBooks Online can meet your rental property management needs.

QuickBooks Desktop for Rental Property Management

QuickBooks Desktop can also be used for rental property management, offering similar functionality to QuickBooks Online. Here are some key points to consider when using QuickBooks Desktop for rental property management:

- Tracking Income and Expenses: QuickBooks Desktop allows you to track rental income and expenses associated with your rental properties. You can create separate accounts or categories for each property to maintain accurate financial records.

- Bank Reconciliation: QuickBooks Desktop provides bank reconciliation features, helping you match your transactions with bank statements to ensure accurate accounting for your rental properties.

- Invoicing and Rent Collection: You can create and send invoices to your tenants directly from QuickBooks Desktop. It also offers options for online payment processing, enabling tenants to pay rent electronically.

- Reporting: QuickBooks Desktop offers various reporting options to analyze your rental property finances. You can generate reports such as Profit and Loss, Balance Sheet, and Cash Flow Statements to gain insights into your property’s performance.

- Integration with Third-Party Apps: QuickBooks Desktop supports integration with third-party applications, allowing you to connect with property management tools, tenant screening services, and other relevant software to enhance your rental property management processes.

- Accessibility and Collaboration: QuickBooks Desktop is installed locally on your computer and may require network access for multi-user collaboration. It may not provide the same level of accessibility as cloud-based solutions.

- Mobile App: Unlike QuickBooks Online, QuickBooks Desktop does not have a mobile app. However, you can access QuickBooks Desktop remotely using remote desktop solutions or by hosting it on a cloud server.

- One-Time Purchase and Subscription Options: QuickBooks Desktop operates on a one-time purchase model, where you buy a license for the software. Intuit, the company behind QuickBooks, also offers an annual subscription plan called QuickBooks Desktop Plus, which includes additional features and ongoing support.

While QuickBooks Desktop offers robust accounting capabilities, it’s important to note that it may lack some industry-specific features found in dedicated rental property management software like Landlord Studio.

Consider your specific requirements, such as portfolio size, customization needs, integration requirements, and your comfort level with desktop software when deciding between QuickBooks Desktop and other rental property management solutions.

Before making a decision, you can explore tutorials, user reviews, and resources provided by Intuit to familiarize yourself with setting up and using QuickBooks Desktop for rental property management.

Ultimately, the choice between QuickBooks Desktop and other software solutions depends on your preferences and needs as a landlord. Take the time to evaluate different options and determine which one aligns best with your rental property management requirements.

Comparing QuickBooks Online and QuickBooks Desktop for Rental Property Management:

QuickBooks offers both online and desktop versions of their accounting software, and both can be used for rental property management. Here’s a comparison of QuickBooks Online and QuickBooks Desktop in the context of rental property management:

1. Accessibility and Convenience:

- QuickBooks Online: It is a cloud-based software accessible from anywhere with an internet connection. You can access your rental property data and perform accounting tasks using any device (computer, tablet, or smartphone).

- QuickBooks Desktop: It is installed on a specific computer and requires local access to the software and data. You can only work on the rental property accounting from the computer where it is installed.

2. Features and Functionality:

- QuickBooks Online: It offers a range of features suitable for rental property management, such as tracking income and expenses, invoicing, bank reconciliation, financial reporting, and integration with various third-party apps.

- QuickBooks Desktop: It provides similar features to QuickBooks Online, including income and expense tracking, invoicing, bank reconciliation, and reporting. Additionally, QuickBooks Desktop offers more advanced features for customization, such as inventory management and job costing. However, these advanced features may not be necessary for most rental property management needs.

3. Cost and Pricing Structure:

- QuickBooks Online: It has a subscription-based pricing model with different plans to choose from based on your business needs. The pricing varies depending on the plan and the number of users.

- QuickBooks Desktop: It follows a one-time purchase model, where you buy a license for a specific version (e.g., QuickBooks Pro, Premier, or Enterprise) and pay for any upgrades or support services separately. The cost is typically higher upfront compared to QuickBooks Online.

4. Updates and Support:

- QuickBooks Online: As a cloud-based software, QuickBooks Online receives regular updates and improvements automatically. The support is typically included in the subscription fee, and you can access customer support through various channels.

- QuickBooks Desktop: Updates for QuickBooks Desktop versions are released periodically, and you have the option to upgrade to newer versions for additional features and support. Support services may require a separate fee or subscription.

5. Integration and Third-Party Apps:

- QuickBooks Online: It has a wide range of integrations with third-party apps and services. This allows you to connect with property management tools, online rent payment systems, tenant screening services, and more, expanding the functionality of QuickBooks Online for rental property management.

- QuickBooks Desktop: While it also supports integration with some third-party apps, the range of available integrations is generally more limited compared to QuickBooks Online.

In summary, both QuickBooks Online and QuickBooks Desktop can be used for rental property management, but there are differences in accessibility, features, pricing, and support. QuickBooks Online is more suitable for those who value remote access and the ability to integrate with other tools, while QuickBooks Desktop may be preferred by those who prioritize advanced customization features. Assessing your specific needs and preferences will help you determine which version of QuickBooks is the best fit for your rental property management requirements.

Choosing the Right QuickBooks Version for Rental Property Management

When it comes to choosing the right QuickBooks version for rental property management, it’s important to consider your specific needs and the features that will best support your financial management requirements. Here are some factors to consider when selecting the appropriate QuickBooks version:

- QuickBooks Online vs. QuickBooks Desktop: QuickBooks offers both an online version and a desktop version. QuickBooks Online is cloud-based, allowing you to access your data from anywhere with an internet connection. QuickBooks Desktop, on the other hand, is installed on a computer and offers more robust features. Consider your preference for accessibility and mobility versus advanced functionality when choosing between the two.

- Chart of Accounts: The chart of accounts is a crucial aspect of managing rental properties in QuickBooks. Look for a version of QuickBooks that allows you to easily set up and customize your chart of accounts to reflect rental income, expenses, and property-specific accounts. This flexibility ensures accurate tracking and reporting for your rental properties.

- Class and Location Tracking: Class and location tracking features in QuickBooks allow you to categorize income and expenses by property or location. This can be beneficial for rental property management, as it provides a clear breakdown of financial data for each property. Check if the QuickBooks version you are considering offers this feature to facilitate accurate property-specific reporting.

- Invoicing and Payment Tracking: Efficient invoicing and payment tracking are essential for rental property management. Look for QuickBooks versions that provide customizable invoice templates, automation for recurring rent invoices, and options for online payment processing. These features help streamline the invoicing process and make it easier to track rent payments from tenants.

- Reporting and Analytics: Reporting capabilities are crucial for analyzing the financial performance of your rental properties. Evaluate the reporting features offered by different QuickBooks versions, including profit and loss statements, cash flow reports, balance sheets, and customizable reports. Ensure that the chosen version provides the necessary reports to monitor the financial health of your rental properties.

- Integration with Property Management Tools: If you use property management software or other tools to manage your rental properties, consider QuickBooks versions that offer integration capabilities. Integration streamlines data transfer between platforms, reduces manual data entry, and ensures accurate financial records across systems.

- Scalability and Additional Features: Consider your future growth plans and the scalability of the QuickBooks version you choose. Some versions offer additional features and advanced functionality that may be beneficial as your rental property portfolio expands. Evaluate the available add-ons and the ability to upgrade to higher-level versions if needed.

- User-Friendly Interface and Support: The user interface and ease of use are important factors to consider, especially if you are new to QuickBooks. Look for a version that offers an intuitive interface, clear navigation, and user-friendly features. Additionally, consider the availability of customer support, tutorials, and resources to help you effectively utilize the software.

By carefully considering these factors, you can choose the right QuickBooks version that aligns with your rental property management needs and supports efficient financial management for your properties. Remember to assess your requirements, compare features, and select a version that offers the necessary functionality to streamline your rental property financial processes.

Conclusion

In summary, choosing between QuickBooks and dedicated rental property management software like Landlord Studio depends on your specific needs and the features required to effectively manage your rental properties. QuickBooks, designed for small to midsize businesses, may lack certain industry-specific features and can be challenging to set up correctly. On the other hand, Landlord Studio offers industry-specific functionality, customizable reports, automated features, and excellent customer support. Consider your portfolio size and desired features when making your decision.